Table of Content

However, they tend to use certain versions depending on the kind of credit for which you’re applying. Here’s a look at the most common FICO scores used for each type of credit. All FICO® Score products made available on myFICO.com include a FICO® Score 8, along with additional FICO® Score versions.

The bank identifies the median score for both parties, then uses the lowest of the final two. The FICO 8 model is known for being more critical of high balances onrevolving credit lines. But one number is perhaps one of the most important numbers of all.

Most Important: Payment History

For example, the latest FICO® and VantageScore models ignore paid collection accounts and give less weight to medical collection accounts. But the older FICO® Score models continue to count collection accounts against you after you pay off the balance. There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using. You also may have frequent access to your score for free through your bank or credit card issuer.

If your loan is considered a higher risk, the lender may impose a minimum score of 620. Even though loans operate under FHA guidelines, the private lenders who originate them have considerable latitude in underwriting them. Wells Fargo is not a credit bureau so when they provide this score, it is actually being run on credit data provided by one of the three major credit bureaus. The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

How Does Your Credit History Affect Getting A Mortgage

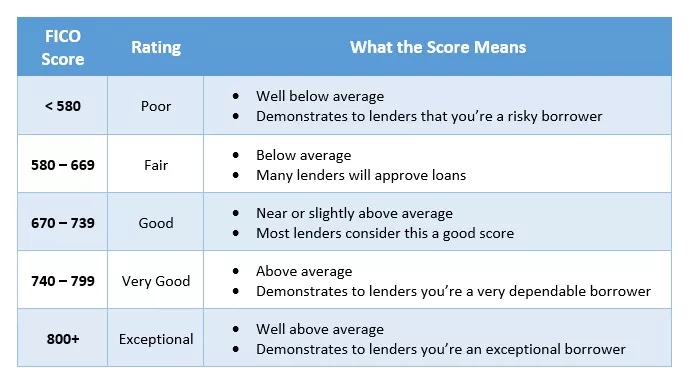

Since there are few numbers that matter as much to your financial wellbeing as your credit score, it helps to know what your scores mean and how they work. As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money. Aside from the scores, payment history and amounts may differ, so its important to see them all. A credit utilization of 30% is good, but less than 10% is better.

It is used by creditors to assess the risk of lending money to a potential borrower. Though FICO has created several auto-specific scores, the base FICO 8 and 9 scores are still widely used in car lending. Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

FICO® SCORE — THE SCORE THAT LENDERS USE®

You can also check your FICO 8 and FICO 9 credit scores through FICO for a fee, or you might be able to access your scores for free from your bank or credit card company. Just as it has for auto loans, FICO has developed a series of scores attuned to the concerns of credit card issuers. FICO bankcard scores are more sensitive to how a borrower has managed their credit cards in the past.

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment. However, you CAN buy a car with a score of 400 or a score of 850. There are a lot of variables that weigh into determining your loan eligibility and interest rates available.

Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Your score is in the score range, from 580 to 669, considered Fair. … Approximately 27% of consumers with credit scores in the Fair range are likely to become serious delinquents in the future. Any score between 700 and 749 is usually considered “good”, while scores from 650 to 700 are “fair”. Lower median rates, higher credit scores typically mean better interest rates and loan options. If you are looking to buy or refinance your mortgage, how do you get a glimpse of your credit scores before applying?

Once again, even if you do it’s likely you’ll be required to pay off any past due balances. Jumbo mortgages are even more credit score sensitive than conventional mortgages. Much like FHA mortgages, VA mortgages are also insured by a government agency – the Veterans Administration. One of the big advantages of VA mortgages is that they offer 100% financing for either purchases or refinances. That means zero down payment if you’re a buyer, and zero equity if you’re a homeowner doing a refinance.

We have the answer, along with how to check your credit score. He’s a regular contributor/staff writer for as many as a dozen financial blogs and websites, including Money Under 30, Investor Junkie and The Dough Roller. The VA doesn’t have specific minimum credit score requirements.

That’s the amount you owe on your credit cards, divided by your total credit limits. For example, if you owe $5,000 on your credit cards, and the total of your credit limits is $10,000, your credit utilization ratio is 50%. The credit bureaus like a ratio below 30%, and the closer you can get to that the better your credit score will be. At 80% and above, the effect is very negative, and even predictive of default.

No comments:

Post a Comment