Table of Content

Your credit score is only one factor that goes into determining your mortgage rate. Other important factors include your loan type, loan term , and the current interest rate market. The best credit monitoring services offer triple-bureau protection, looking at your information across all three credit bureaus.

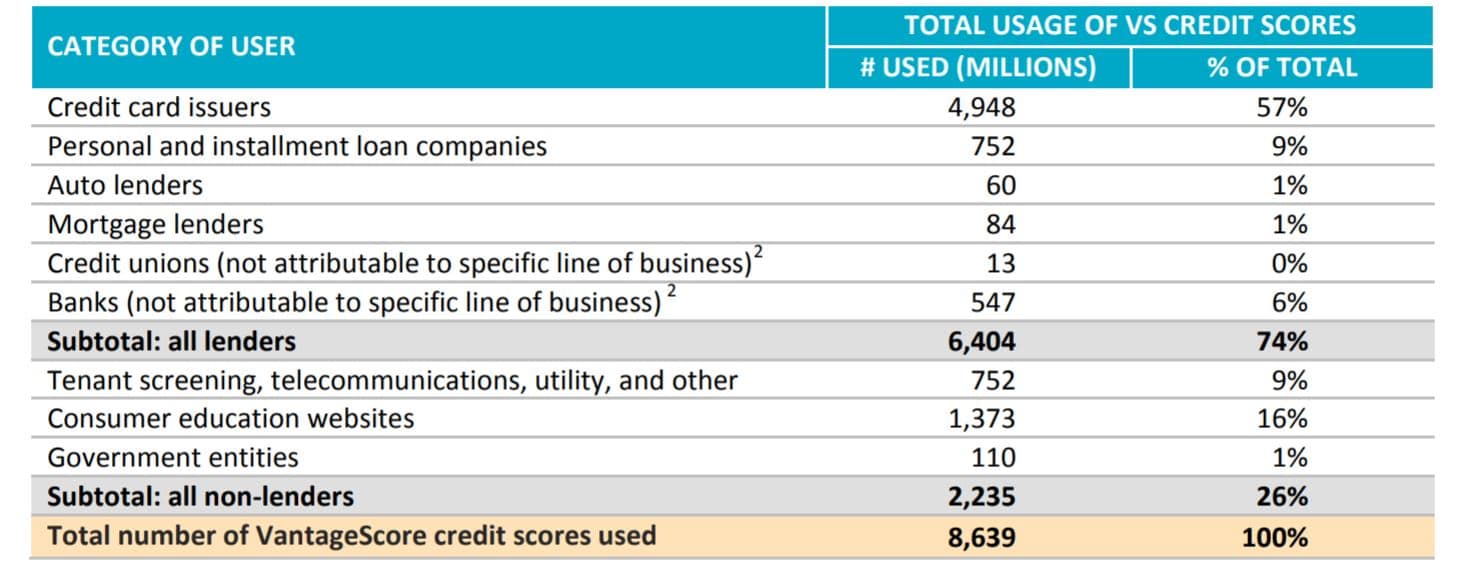

But VantageScore, which the three main credit bureaus founded, is still used quite often. In addition, sometimes lenders will use multiple models, depending upon your score and credit history, as a way to skirt restrictions to get you a loan. Most services that offer free credit scores don't give you the classic FICO® Scores that mortgage lenders generally use. For example, you can check your FICO® Score 8 for free from Experian. Or, if you have an Experian CreditWorks℠ Premium membership, you can get multiple FICO® Score versions, including the FICO® Score 2 from Experian. Your credit scores can be an important factor in getting approved for a mortgage and the rates you're offered.

Should You Buy Down Mortgage Rate

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans. Don’t forget that your credit scores are just a part of the data your lender will use to qualify you for your new home loan. Are you applying for an FHA mortgage and have missed payments of any kind on your credit history in the 12 months leading up to your loan application? Your home loan application will be harder for the lender to approve in such cases.

To further complicate things, you can also have VantageScore® credit scores from each bureau. If you can't afford to pay down your credit card balances, you could apply for a debt consolidation loan and use the money to pay off your credit cards. Installment loans, such as personal loans, won't impact your utilization rate.

What FICO Score Do You Need to Buy a Home?

That said, some lenders might go a little below – but probably not lower than 580 – if you are otherwise a strong borrower. Equifax and Experian are the most commonly used credit bureaus by auto lenders. They offer services that are directed specifically at the auto industry, and each gets a portion of their revenue from the industry. These Chase auto loan rates typically are for people with an excellent FICO credit score of at least 740.

As such, mortgage lenders typically have stricter guidelines than other loan types when you apply. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, this is still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates. Some people might think having a higher credit score won't make a big difference when it comes to interest rates. Lenders generally take into account FICO Score ranges (i.e., 620+, 660+, 700+), and having a score in a higher range could save you thousands of dollars over the life of a mortgage loan.

Checking if the site connection is secure

Per the Federal Trade Commission, you can pull one free copy of your credit report from each of the three main agencies per year. According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 . If two of the three scores are the same, lenders use that one, regardless of whether it's higher or lower than the other one. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too.

Lenders want to determine that you have the ability to repay your auto loan before they finance a car. This goes beyond just running numbers based on an interest rate. Lenders should assess your income, assets, employment, credit history and monthly expenses to determine that you're able to pay back the loan. While Experian and Equifax are the most popular bureaus among auto lenders and car dealers, TransUnion can also be used for auto loan decisions.

Additionally, all participating FHA lenders have a set of credit score ranges used to determine a borrower’s creditworthiness. Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card. Even one late payment could hurt your credit scores, and you want to make sure your recent credit history is as clean as possible before applying for a new loan. Your credit utilization rate is the percentage of your revolving account limits that you're currently using, and it's an important credit scoring factor.

If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Compensation may factor into how and where products appear on our platform .

Used by more than 90% of lenders, according to the company, the scores are designed to help assess a borrower’s creditworthiness. That’s because lenders look at different versions and types of FICO scores depending on the type of credit you’re seeking and other issues. An industry standard since they were first introduced over 30 years ago, FICO® Scores are used by 90% of top lenders.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Lenders can choose which credit score they want to use when evaluating your auto loan application. Different lenders might use different scores, and even the same lender might test several credit scores. As a result, you likely won't know exactly which credit score the lender will see when you apply for an auto loan.

Apartment Credit Score Usually, a credit score of 620 or higher will allow you to rent an apartment with little problem. Apartment leasing sources stated that a credit score lower than 620 received a “standard risk risk” rating and a leasing denial. So before deciding to purchase a home, check your FICO Score and consider whether you might be on the cusp of getting a better interest rate. You can use the myFICO Loan Savings Calculator to calculate potential savings based on your personal financial situation. Money Under 30 compares the best tools for tracking your credit report and score.

Each model only looks at the information in one of your credit reports from Experian, Equifax or TransUnion to determine your score. A higher score is best because it indicates you are less likely to miss a loan payment. A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one.

The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and there's plenty of good reasons why. A good FICO score is key to getting a good rate on your FHA home loan. To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be. Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC.

No comments:

Post a Comment